The Intelligence Revolution: Forging the Future of Financial Services

A fundamental reshaping of a pillar of our economy is underway.

We live amid relentless AI hype. Weekly model releases, sensational demos, existential debates. It’s tempting to dismiss much of it as commercial noise. Yet beneath this tumultuous surface lies a real paradigm shift. The Intelligence Revolution is real, and we are already in its early innings.

Two foundational truths underpin this new era:

Current AI capabilities enable massive automation and value creation (see Appendix 1)

AI progress continues to accelerate (see Appendix 2)

This revolution, much like the industrial revolutions of the past, won’t happen all at once. There are significant problems to solve, bottlenecks to remove, and infrastructure to build. But ultimately, AI will transform industries.

The Intelligence Revolution will change how companies operate on the inside, how they interact with their customers, and the goods and services they provide.

A Critical Arena for the Intelligence Revolution

Many industries are poised for rapid, even unrecognizable disruption. Among them, financial services stands out as one of the especially critical. While it may not be the first industry transformed, financial services is a cornerstone of modern society. Its central roles (facilitating transactions, financing growth, safeguarding investments) mean its transformation will reverberate deeply in our lives.

Several key characteristics make financial services a highly potent arena for the Intelligence Revolution:

Financial services run on exceptionally rich data. Decades of transaction records, market movements, customer behaviors, and risk assessments form a deep store of insights. These insights are invaluable for AI, enabling hyper-personalized experiences (e.g., tailored investment advice, predictive financial planning, personal concierge service) that could extend beyond traditional financial offerings

Simultaneously, financial services operate under the highest regulatory scrutiny. This demands exceptionally high standards for reliability, fairness, transparency, and security. While challenging, it also means AI solutions proven to be robust and compliant in finance will be truly transformative across other regulated sectors

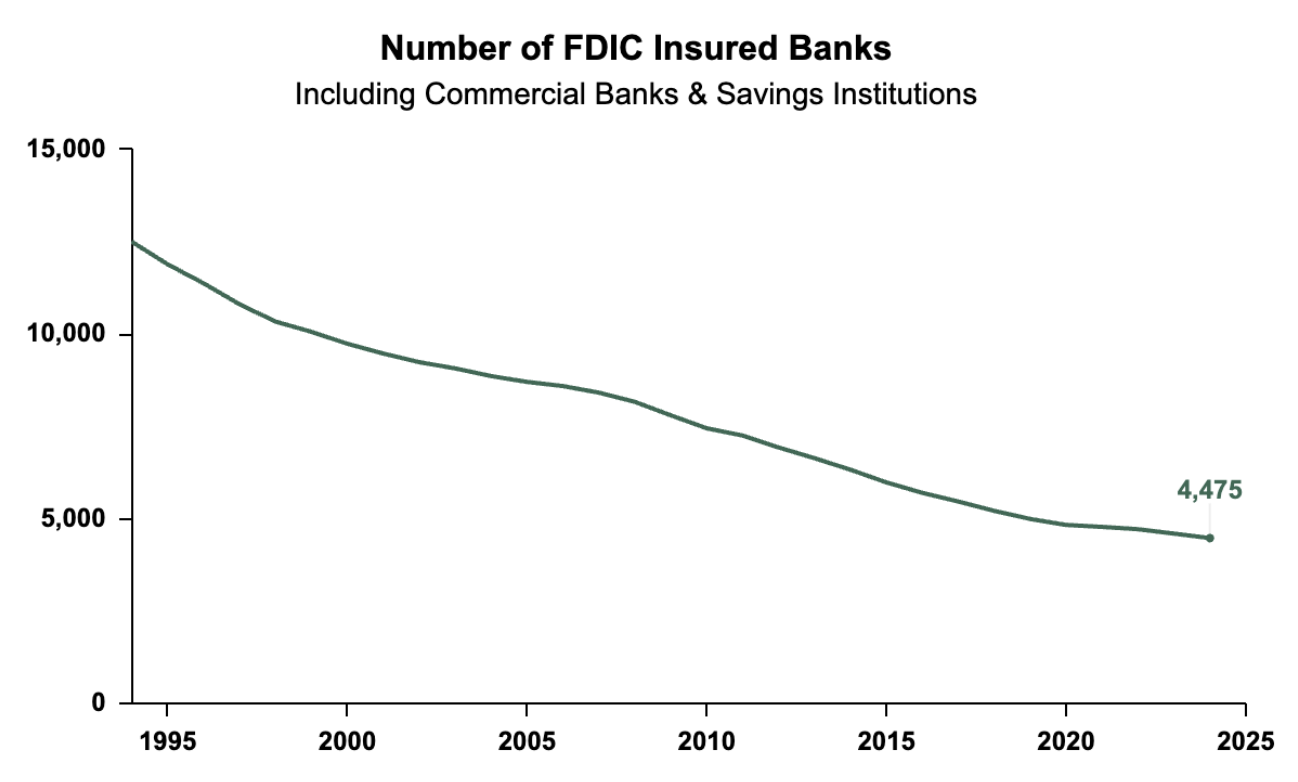

Finally, the landscape is characterized by intense competition driven by consolidation. The number of FDIC insured banks has fallen by more than half since the mid-90s (Exhibit 1), concentrating deposit market share in the top 10 largest institutions, which have grown from holding 12% to 48% of the market (Exhibit 2). AI could either be used by these incumbents to leverage their immense scale and squeeze out smaller players, or by agile challengers who can redefine value in a highly contested market

Exhibit 1: Number of FDIC Insured Institutions

Source: https://banks.data.fdic.gov/

Exhibit 2: Deposit Market Share of Top 10 Banks

Source: https://banks.data.fdic.gov/

A Fork in the Road

The Intelligence Revolution presents an important fork in the road for financial services.

The large investments needed (e.g., technology infrastructure, compute power, and specialized talent) to compete at the frontier of AI could further consolidate the market into a handful of dominant companies. Their scale could create a flywheel, where better AI draws more customers and data, continuously improving their AI capabilities.

Alternatively, AI could empower a new wave of competition.

Agile players, and potentially new entrants, could leverage specialized AI to carve out highly profitable niches by offering superior value where the giants are too generalized, or too slow, to execute effectively.

Such transformative shifts are not without precedent; history teaches us that major technological waves create distinct winners and losers. The dawn of the internet saw Charles Schwab fundamentally reshape brokerage models, capturing substantial market share by pioneering online trading. The mobile revolution propelled Square to prominence by simplifying financial interactions for small businesses and consumers alike.

The Intelligence Revolution will be no different. Some companies will adapt, innovate, and thrive. Others will struggle, weighed down by legacy systems, outdated thinking, or inability to adapt swiftly.

Financial Institution Responses to AI

In this new era, three broad categories of strategic response are emerging:

The pioneers are well-capitalized and technologically ambitious. They invest significantly in tech modernization, elite AI talent, substantial computational resources, and a culture of relentless experimentation. Their goal is to define the frontier, create proprietary AI advantages, and capture first-mover benefits. However, they also face risks: high burn rates, uncertainty about technological approaches, and internal bureaucracies that might stifle innovation

The fast followers lack the scale or risk appetite to compete at the frontier directly, but remain keenly aware of the Intelligence Revolution. Their playbook involves meticulous market observation, adopting proven AI solutions, and targeting high-value or underserved market segments. This approach demands deep domain expertise, agility, and a focus on maximizing ROI

The unaware have yet to fully grasp AI's potential. Their approach to AI is superficial (often limited to basic off-the-shelf tools). They lack the situational awareness and strategy to capitalize on AI opportunities or adequately position themselves for the future

In a race characterized by exponential progress, playing catch-up will be increasingly challenging. A clear and actionable AI strategy becomes critical. Institutions must stay informed on the latest developments, rigorously analyze new use cases, and thoughtfully envision the future of financial services.

Appendix

Appendix 1: Current AI capabilities enable massive automation and value creation

Recent work by Model Evaluation & Threat Research (METR) reframes model capability in terms of task-length the agent can finish at a given success probability. Their latest March 2025 study shows that the latest frontier agents can complete tasks requiring up to ~15 minutes of skilled-human work with ≥80% accuracy. The same study shows both the 50% and 80% “time horizons” have been doubling roughly every seven months since 2019.

U.S. finance-and-insurance firms employ ~6.7 million people in core operations, compliance, finance, and customer service. At an average fully-loaded cost of $47 per hour, this represents about $640 billion in annual labor spend.

Workflow audits across retail banking, asset management, and insurance put 15-25% of staff hours into sub-15-minute tasks, for example:

Drafting KYC/AML event notes or SAR preliminary approvals

Reconciling transaction breaks

Pulling data for credit or risk analysis

Writing after-call summaries and customer emails

Formatting routine regulatory reports and decks

All sit squarely within today’s 80% time horizon.

If only 10-20% of total labor hours shift to AI co-pilots for these tasks, that would unlock $60-130 billion in annual capacity. Crucially, that capacity should be re-deployed toward building deeper customer relationships, stronger risk oversight, or faster product cycles.

These tasks are only part of today’s opportunity. Today, AI can already:

Boost knowledge work productivity using readily available tools, such as drafting and summarizing emails, and conducting in-depth market research

Substantially accelerate software development, including code refactoring and test authoring

Deliver hyper-personalized AI marketing campaigns tailored to individual customer needs and preferences

All this is within the capabilities of AI models today. It is critical to recognize that current AI systems are inherently probabilistic and must be approached accordingly. Constructing and scaling valuable AI systems demands robust safeguards and procedures to mitigate any errors. This demands adapting existing risk management frameworks to address this new distinct characteristic of AI.

Appendix 2: AI progress continues to accelerate

The pace of AI development is not merely linear; it's accelerating, compounding progress beyond the task horizon expansions noted in Appendix 1 (where skilled task automation capabilities are doubling roughly every seven months). This rapid advancement is driven by progress on multiple fronts:

Scaling Pretraining: Model parameters have surged from billions to trillions in under five years. This explosion in scale, fueled by exponential growth in effective compute (driven by hardware innovations and larger processing clusters) and sophisticated algorithmic improvements, is unlocking qualitatively new reasoning and multimodal capabilities. The result is more sophisticated models with a deeper understanding and broader capabilities

Scaling Reinforcement Learning: The industry has recently demonstrated the successful application of reinforcement learning techniques to Large Language Models. This breakthrough is poised to deliver massive performance improvements, particularly in domains with verifiable outcomes, such as complex problem-solving in coding and mathematics

Maturing Infrastructure and Protocols: The ecosystem supporting AI development is rapidly evolving. Key advancements include the emergence of more sophisticated agentic architectures (allowing AI to perform sequences of actions), standardized protocols for model interaction (like the proposed Model-Centric Protocol), and increasingly seamless tool integration. These developments are making AI systems more capable, reliable, and easier to deploy

The combination of all three yields rapid progress. Frontier models impressively cleared 90% accuracy on demanding benchmarks like MMLU and GSM-8K in Q1 2025 (+30 pts in just two years). Additionally, tool-augmented AI agents can now independently resolve over 70% of issues on the SWE-Bench GitHub benchmark.

All current indicators suggest these three vectors have years of continued progress ahead of them. Furthermore, this outlook doesn't factor in potential step-change breakthroughs from areas like continual learning or enabling AI models to directly utilize computers, which could unlock further improvements.

This compounding acceleration underscores the exponential nature of the Intelligence Revolution. Capabilities that seem beyond AI models today will likely become commonplace and economically viable sooner than most anticipate. The pace of AI progress is not just fast, it’s accelerating. The time to prepare is now.